GASB 89 and AFUDC - Help or Hurt Electric Ratemaking?

Does GASB 89 treat ratepayers fairly?

Governmental Accounting Standards Board (GASB) Statement No. 89, Accounting for Interest Cost Incurred Before the End of a Construction Period requires municipal utilities to expense construction period interest unless a utility chooses to record capitalized interest as a "regulatory asset". Not capitalizing interest would exclude those costs from electric rates.

Capitalized interest can be a substantial part of the construction costs of major projects. We see a number of municipal electric utilities of all sizes following the option to expense construction interest. Does this do a disservice to their ratepayers? We discuss the impacts in this article.

Key Takeaways

1. GASB 89, effective in 2021, requires municipal utilities to expense construction period interest rather than adding construction interest to an asset's value, which is the electric industry best practice.

2. The electric industry's rate foundation is based on the approach that current ratepayers pay for their current use of the electric system that serves them.

3. Not capitalizing construction interest under-recovers the asset's value in electric rates, leaving a portion of the replacement cost of the financed asset to be borne by future ratepayers.

4. GASB 89 does have an exception to record construction interest as a regulatory item. While this complicates the accounting, it is preferable to NOT recording construction period interest.

Electric power plant construction -Capitalized interest is a major component

What is capitalized interest?

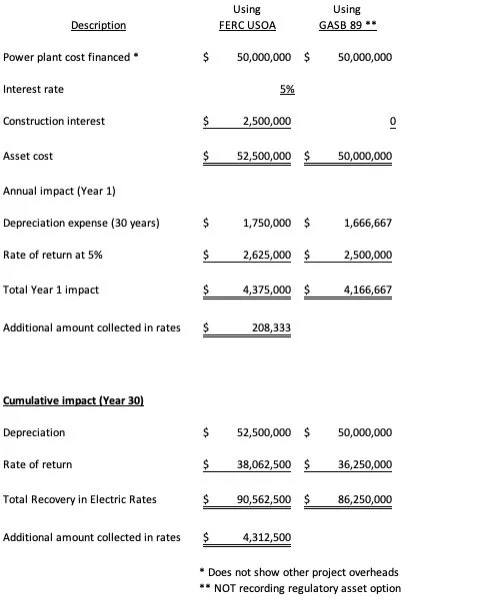

When a major construction project is undertaken, the source of funds for the project is often outside financing. In the case of a major utility project, say building a power plant, a utility will sell revenue bonds to finance the project. If $50 million of revenue bonds are sold to bondholders at a rate of 5% interest, in our simplified example, the project will incur roughly $2.5 million of capitalized interest ($50 million x 5%).

Ask the question, "why did the utility sell $50 million of bonds?" In this case, was it to finance the construction of a power plant? If so, the interest incurred on the bonds directly resulted from this action. The capitalized interest cost should be part of the project cost by that logic and industry best practices.

The Federal Energy Regulatory Commission's Uniform System of Accounts (FERC USOA), which is the industry standard used in electric utility accounting, says in Plant Instructions 3 (17) that construction costs include capitalized interest.

In the hierarchy of accounting standards, GASB outranks FERC. Municipal utilities are required to follow GASB, so NOT following GASB 89 is not an option. But, there ARE options within the goalposts of GASB 89.

Why do some municipal utilities decide not to capitalize interest?

The Governmental Accounting Standards Board argued in developing GASB 89 that interest costs do not increase the service capacity of an asset. However, that argument does not consider that debt funding is the major tool used in the utility industry to construct assets. The standards of the Financial Accounting Standards Board and the Federal Energy Regulatory Commission's Uniform System of Accounts recognize the capital costs of utilizing funds for construction.

Utility Accounting and Rates Specialists provides on-line/on-demand courses on operations and construction project accounting, rates, and management for new and experienced co-op and utility professionals and Board members. Click on the button to see a highlighted listing and description of our course offerings.

What are the impacts of capitalized interest?

As an example, the municipal utility incurs $2.5 million of construction period interest. If the utility capitalizes this interest cost, it would recover the capitalized interest through its electric rates over the power plant's life, which is 30 years. The recovery is through depreciation expense and return on ratebase.

If the utility expenses the construction interest as required in GASB 89, the $2.5 million of construction period interest will not be part of the asset cost. So, depreciation expense and the rate of return on ratebase will be lower and customer electric rates will be lower.

The comparison of the two treatments is shown in Illustration 1

Difference in electric rates - Including construction interest vs. excluding construction interest

Including construction interest leads to an additional collection of $4.3 million in customer rates over the life of the power plant. The additional amount will be used to offset some of the inflationary increase in the cost of the subsequent power plant to be built, replacing the current one. If the construction interest is expensed, the additional costs of the next power plant must be financed.

Don't we like lower electric rates?

Sure, we all like lower electric rates. But paying for electric service provides with the immense benefits that electricity provides. Electric rate theory is that current customers should pay for their current use of the electric system. Part of that ratepayer obligation is to pay for debt service on debt used to construct assets (like the power plant), depreciation expense on current assets (used for their replacement), and contribute towards inflation in asset replacement. Omitting construction interest from an asset's value puts that burden on future ratepayers.

Municipal electric utilities have no choice and must follow GASB 89 - But there are options

GASB 89 includes an exception that allows an electric utility to capitalize interest as a "regulatory asset" rather than part of the asset's value. While the GASB 89 exception complicates the recording of construction interest (by making it a separate asset that must be tracked apart from the main financed asset, i.e. the power plant), doing so is still in the best interests of ratepayers, both current and future.

What is the best for your ratepayers?

You know your ratepayers best, of course. We recommend capitalizing interest as a regulatory asset using the GASB 89 option rather than expensing the interest. Capitalizing construction interest is fair and equitable to current and future ratepayers, follows electric industry standards, and the practices followed by investor-owned utilities and cooperatives.

About Russ Hissom - Article Author

Russ Hissom, CPA is a principal of Utility Accounting & Rates Specialists a firm that provides power and utilities rate, expert witness, and consulting services, and online/on-demand courses on accounting, rates, FERC/RUS construction accounting, financial analysis, and business process improvement services. Russ was a partner in a national accounting and consulting firm for 20 years. He works with electric investor-owned and public power utilities, electric cooperatives, broadband providers, and gas, water, and wastewater utilities. His goal is to share industry best practices to help your business perform effectively and efficiently and meet the challenges of the changing power and utilities industry.

Find out more about Utility Accounting & Rates Specialists here, or you can reach Russ at russ.hissom@utilityeducation.com.

The material in this article is for informational purposes only and should not be taken as legal or accounting advice provided by Utility Accounting & Rates Specialists. You should seek formal advice on this topic from your accounting or legal advisor.