Electric Cooperative Financial Strategies - Cash Reserves and Patronage Capital Policies

Managing your electric co-ops' patronage capital policy is a key part of financial strategy

Electric cooperative financial strategies include the use of operating cash flows, cash reserves, debt, and customer investments, which are called patronage capital. What is patronage capital, and how can your cooperative establish a patronage capital policy that maintains proper cash balances and cash flows while refunding capital credits or power refunds to your owners?

Article Takeaways

Patronage capital is investments by electric co-op customers in the cooperative's equity and represent an ownership interest by the co-op’s customers.

Establishing cash reserves is the first step in any policy development for co-op (or utility) financial management.

Long-term co-op financial planning incorporates cash reserve, equity, capital improvements, rate changes, and debt issues for a holistic and comprehensive approach.

Utility Accounting and Rates Specialists provides on-line/on-demand courses on operations and construction project accounting, rates, and management for new and experienced co-op and utility professionals and Board Members. Click on the button to see courses that will enhance your career skills and provide value to your organization!

What is patronage capital and how does it impact electric co-op finances?

Electric cooperatives had their roots in the New Deal policies of the 1930s. When the Rural Electrification Administration (REA) began, funds were loaned to applicants to construct electric facilities in rural areas. The program rapidly grew the electrification of rural America. The REA later became part of the Rural Utilities Service (RUS), which is the oversight body of many electric co-op financial and reporting matters.

The financing of electric cooperatives was and is a mixture of loans from the REA/RUS, electric rates, and patronage capital. Patronage capital is the amounts invested in the co-op by customers through their electric rate payments.

After determining that the cash flow needs of the co-op have been met and that the co-op has adequate cash reserves to serve customers, the margin on sales that a co-op has each year is allocated to a member's patronage capital account. A balance of a customer’s patronage capital represents ownership in the electric co-op and carries with it a vote in the operation of the co-op.

This overall patronage and capital credit process is as follows:

Electric co-op patronage capital process

The balance in each co-op member's patronage capital account is calculated annually.

Many electric co-ops have policies where a portion of a customer’s patronage capital is returned to them in years where earnings of the co-op exceed budgets. This is called the retirement of patronage capital. .

Best practices in cash reserve balances - How do we calculate optimal cash flow needs?

While this article discusses the patronage capital process, if your organization is a public power or investor-owned utility, then this section on best practices in calculating cash reserve balances also applies to your utility.

The simple formula for calculating reserve needs is:

Cash reserves formula

The wild card in this equation is the cash reserves amount. What is an optimal balance, but not too much to suggest that electric rates are set at a level that is too high? We'll dive into the mechanics of calculating the amount of cash to retain in the business with a detailed example shortly.

Cash reserves serve to build organization equity, which minimizes debt requirements. Other goals for cash reserves include providing funds for capital projects and mitigating rate increases.

Cash reserves and the bond rating agencies

A good resource to determine unrestricted cash reserve needs can be based on metrics published by bond rating agencies. For example, Moody's Investor Service (Moody's) uses the following levels to determine the weighted impact of unrestricted cash reserves on a bond rating:

Moody’s ranking of days cash on hand

Unrestricted cash on hand is calculated as:

Unrestricted cash and investments + lines of credit x 365 days divided by annual operating and maintenance expenses

What is the right amount of cash reserves to have available?

But realistically, cash reserves are more than just unrestricted cash and investments. At a minimum, there should be enough cash reserves to pay for one operating cycle's expenses for openers. For example, if your co-op purchases power from a G&T Co-op or produces power, there will be a lag between purchasing this month's power and payments from customers at the end of next month. Next, capital project needs must be funded for a defined period. Depreciation expense in customer rates is designed to pay for routine fixed-assets replacement. If not all of the amounts recovered in customer rates through depreciation are used in a year, the unused portion should be set aside as reserves. Amounts should also be reserved for capital additions that are slated to be constructed and paid for with internal reserves.

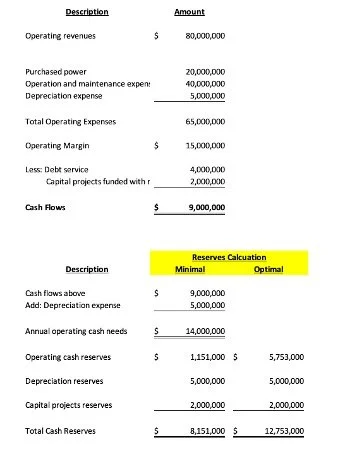

An example of a cash reserves calculation is based on this scenario for Member Service Cooperative:

1. Co-op operating expenses for the year are $40 million plus $20 million for purchased power

2. Depreciation expense is $5 million

3. Routine capital improvements in the current year are $5 million

4. Debt service for the year is $4 million

5. Additional capital projects to be funded with reserves in the current year are $2 million

What are the minimal and optimal cash reserves for Member Service Cooperative? The minimal amount is calculated using 30-days of unrestricted cash on hand. The optimal amount is based on 150 days of cash on hand, which is Moody's minimum for an "Aa" rated bond.

Cash reserves calculation example

Each organization will be different in its approach to cash reserves. The reserve philosophy is based on the risk tolerance of management and the Board and the decades of embedded history of the organization.

Allocating margins to each member’s patronage account

A simple and consistent approach to allocating margins to each patronage capital account is with the following formula:

Margin/Total Sales = Allocation Factor

Allocation Factor x Individual Member Payments (Sales) = Share of patronage capital

The share of patronage capital is credited to the member's patronage capital account. The member’s patronage capital is tracked by year of the margin allocation.

Retiring patronage capital

Patronage capital can be returned, aka “retired” to both current co-op members and former members. The co-op’s Board of Directors will review financial results and approve the return of patronage capital. A common method of retiring member patronage capital is the FIFO (first in, first-out) method. The members with the oldest balances of patronage capital receive a check for their balance and their equity is removed from the patronage capital equity account in the general ledger.

As an example policy, the Basin Electric Cooperative, a $2 billion electric cooperative, returned $64 million to members in 2021 through a combination of rate refunds and retirement of capital credits. This philosophy uses a combination of rewarding current ratepayers for their system contributions while paying a dividend to legacy capital credit holders for their past investments in the co-op. This is a twist on the FIFO method. But the key is Board policy of a consistent approach. The Boards of co-ops are made up of members, so this approach was definitely agreeable to the co-ops' membership.

The electric co-op financing model

The electric co-op financing model uses the proven combination of equity and debt. Cash reserves and patronage capital are a way to manage the equity portion of the equation. The key is to incorporate reserve, patronage capital planning, electric rates, capital additions, and debt issues into the long-ranging planning and forecasting of the co-op. A written policy with Board approval is key to a smooth and beneficial process.

About Russ Hissom - Article Author

Russ Hissom, CPA is a principal of Utility Accounting & Rates Specialists a firm that provides power and utilities rate, expert witness, and consulting services, and online/on-demand courses on accounting, rates, FERC/RUS construction accounting, financial analysis, and business process improvement services. Russ was a partner in a national accounting and consulting firm for 20 years. He works with electric investor-owned and public power utilities, electric cooperatives, broadband providers, and gas, water, and wastewater utilities. His goal is to share industry best practices to help your business perform effectively and efficiently and meet the challenges of the changing power and utilities industry.

Find out more about Utility Accounting & Rates Specialists here, or you can reach Russ at russ.hissom@utilityeducation.com.

The material in this article is for informational purposes only and should not be taken as legal or accounting advice provided by Utility Accounting & Rates Specialists. You should seek formal advice on this topic from your accounting or legal advisor.