Best Practices in Electric Cost of Service Studies

Electric rates are electric rates - the method doesn’t matter, right?

Utility rates drive revenues and recover the full costs of operations, debt service, and capital additions. While most investor-owned utilities, electric cooperatives, and large municipal utilities use the “utility method” to develop electric rates, many small to mid-sized utilities base their rates on utility cash flows. What’s the difference? Does it matter? This article dives into the differences between the two methods and provides an opinion on what method would benefit your utility’s ratemaking and cost recovery. The basic approach is:

Revenue requirement ——> Cost of service study —-> Develop electric rates

Developing the revenue requirement

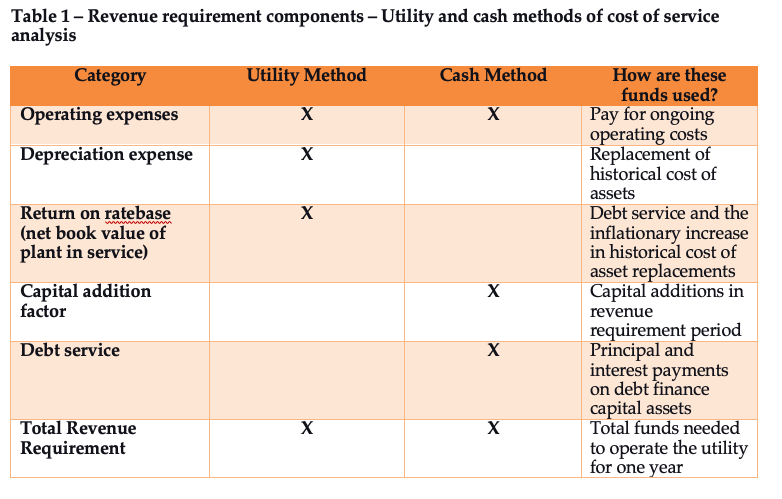

Utility revenues should be sufficient to recover annual operating costs, debt service, and capital additions. The first step in the ratemaking process is to develop a “revenue requirement” that forecasts those three items for one year into the future. The two methods produce the revenue requirement in the manner shown in Table 1:

Electric revenue requirement components

Utility Accounting and Rates Specialists provides on-line/on-demand courses on operations and construction project accounting, rates, and management for new and experienced co-op and utility professionals and Board Members. Click on the button to see courses that will enhance your career skills and provide value to your organization!

The cost of service analysis uses the revenue requirement to develop cost allocations

Step 2 allocates the revenue requirement to the significant cost categories - electric demand (kW), energy (kWh), and customer costs in a cost of service study. While costs are allocated into deeper subsets of these categories, these three main drivers are the engine that runs the cost of service and customer rates.[1]

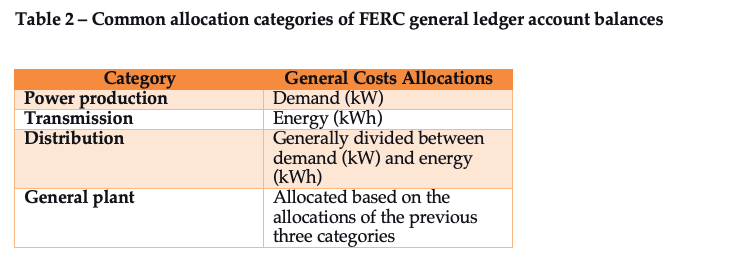

Costs are allocated to the cost of service categories based on how the costs are classified in the general ledger. For example, the major types of plant in service accounts are allocated as follows[2]:

Cost allocation categories

Under the utility basis of ratemaking, the current FERC account balances of ALL current utility plant in service are allocated, not just current year plant additions.

Contrast this to the cash basis approach, where costs are generally allocated based on the makeup of the planned additions for the revenue requirement period (e.g., poles, overhead and underground lines, power production, general plant) a hybrid approach based on the average annual additions. Also, debt service is generally allocated based on the purpose of the borrowing, which is an advantage over the utility method as it is more precise.

Our utility has always used the cash method for our cost of service studies; can we switch?

Switching methods is not difficult since both methods' objective is to determine the revenue requirement for one year in the future. Changing from the cash method to the utility method involves plugging next year's budget into the utility method and adjusting the rate of return to yield the cash needs of the utility/coop. So, why not just use the cash method, you say? The difference is the added accuracy of the cost of service allocations to demand, energy, and customer costs, using the utility method.

Your call to action is to try the utility method with your next cost of service study. You may find that costs are being allocated differently than under the cash method. Still, the allocations will more accurately reflect general ledger costs and the overall makeup of your utility/coop electric system built to serve your customers.

[1] Step 3 is to design customer rates, which is outside of our discussion here

[2] In a cost of service study, this approach is more refined

About Russ Hissom - Article Author

Russ Hissom, CPA is a principal of Utility Accounting & Rates Specialists a firm that provides power and utilities rate, expert witness, and consulting services, and online/on-demand courses on accounting, rates, FERC/RUS construction accounting, financial analysis, and business process improvement services. Russ was a partner in a national accounting and consulting firm for 20 years. He works with electric investor-owned and public power utilities, electric cooperatives, broadband providers, and gas, water, and wastewater utilities. His goal is to share industry best practices to help your business perform effectively and efficiently and meet the challenges of the changing power and utilities industry.

Find out more about Utility Accounting & Rates Specialists here, or you can reach Russ at russ.hissom@utilityeducation.com.

The material in this article is for informational purposes only and should not be taken as legal or accounting advice provided by Utility Accounting & Rates Specialists. You should seek formal advice on this topic from your accounting or legal advisor.