GASB 96 and Cloud Computing - It’s Implementation Time!

As utilities move information technology to the cloud - GASB 96 shows the way

The implementation period for GASB 96 Subscription Based Technology Arrangements is here; how exciting! Well, if you do accounting for a living, you know that there’s a certain satisfaction in implementing new standards and changing the face of your financial statements, especially when it is a benefit to your organization.

What is the benefit of using GASB 96 to account for your move to cloud-based software systems? GASB 96 allows you to recognize that you are entering into an agreement that will benefit your organization long-term. It also recognizes that cloud-based software is not static, i.e., you’ll now experience more frequent software upgrades with less work. The concern in the power and utilities business is always, “how will we recover our costs from ratepayers?”. GASB 96 does not change that. Let’s take a look at implementing the standard smoothly and effectively.

Effective date

Statement No. 96 is effective for fiscal years beginning after June 15, 2022. Earlier implementation is allowed and encouraged by the GASB.

Cloud computing with software as a service (SaaS)

Key article takeaways

1. GASB 96 is effective for fiscal years beginning after June 15, 2022.

2. GASB 96 is similar to GASB 87 Leases and recognizes that long-term software as a service or subscription-based software agreements represents long-term assets and liabilities for a utility.

3. The GASB 96 asset can be recovered in customer rates using the cash or utility basis method for developing the cost of service.

Utility Accounting and Rates Specialists provides on-line/on-demand courses on operations and construction project accounting, rates, and management for new and experienced co-op and utility professionals and Board members. Click on the button to see a highlighted listing and description of our course offerings.

GASB 96 overview

GASB 96 establishes the term SBITA (subscription based information technology arrangement), which is the contract terms between your organization and the software provider. An SBITA gives your organization the right to use software hosted by the provider for an extended term. Think of GASB 96 as GASB 87 (lease accounting) for software. Your organization now has ownership of a tangible asset. GASB 96 provides the tools and definitions to calculate what that ownership is worth.

Items needed to calculate the value of the SBITA

To calculate the SBITA value, you will need the following information:

1. The software contract

2. Contract payment amount

3. Length of the contract

4. Information on any options to extend the contract

5. The interest rate charged by the vendor for the SBITA, or

6. The weighted cost of capital rate of your organization

Once this information is gathered, the calculation of the SBITA is a spreadsheet exercise.

Practical application for your utility

The subscription asset should be initially measured as the sum of:

(1) the initial subscription liability amount,

(2) payments made to the SBITA vendor before commencement of the subscription term, and

(3) capitalizable implementation costs, less any incentives received from the SBITA vendor at or before the commencement of the subscription term.

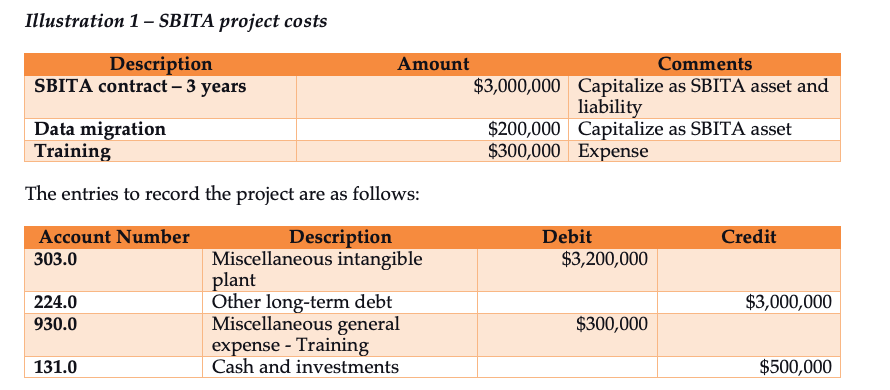

Your utility is implementing the SBITA and capitalizes the contract as follows (the account numbers are based on the Federal Energy Commission’s (FERC) Uniform System of Accounts for Electric Utilities):

The SBITA is discounted at the utility’s weighted average cost of capital and amortized over the term of the contract. The weighted average cost of capital (WACC) is the weighted interest cost of financing and internal reserves used to fund the utility's or co-op's annual infrastructure construction. The imputed interest rates of short-term and long-term debt and internal reserves is applied as an overhead to construction costs.

The SBITA liability is reduced as the annual subscription payments are made.

Is an SBITA considered debt for bond rating purposes?

Regarding an SBITA, you should reach your own conclusion and comfort on an answer, but initial feedback from ratings agencies is that an SBITA is not debt for ratings purposes.

How GASB 96 addresses additional situations

SBITAs may change throughout the relationship with the software provider. GASB 96 is flexible in addressing scenarios that may occur:

1. Contract modifications - if the SBITA is changed, i.e., contract length or equipment changes, the SBITA should be remeasured and the assets and liabilities changed to the newly calculated SBITA amount.

2. Contract termination - A gain or loss is recognized on termination of an SBITA before the end of the original contract and measurement date.

The SBITA - benefit or detriment to the utility cost of service?

The SBITA concept in GASB 96 is easy to implement and has the benefit of recognizing an asset where this arrangement would have been treated as a straight-up operating expense in the past. The treatment as an asset will allow earning a rate of return on the asset for utility rate purposes, ensuring that cash flows are adequate for full cost recovery.

About Russ Hissom - Article Author

Russ Hissom, CPA is a principal of Utility Accounting & Rates Specialists a firm that provides power and utilities rate, expert witness, and consulting services, and online/on-demand courses on accounting, rates, FERC/RUS construction accounting, financial analysis, and business process improvement services. Russ was a partner in a national accounting and consulting firm for 20 years. He works with electric investor-owned and public power utilities, electric cooperatives, broadband providers, and gas, water, and wastewater utilities. His goal is to share industry best practices to help your business perform effectively and efficiently and meet the challenges of the changing power and utilities industry.

Find out more about Utility Accounting & Rates Specialists here, or you can reach Russ at russ.hissom@utilityeducation.com.

The material in this article is for informational purposes only and should not be taken as legal or accounting advice provided by Utility Accounting & Rates Specialists. You should seek formal advice on this topic from your accounting or legal advisor.