AMI - the new standard in allocating overhead costs of service?

Using Automated Metering Infrastructure technology to allocate electric project overhead costs

A scintillating headline, but something must have intrigued you to keep reading. This article outlines some of the advances in cost allocation theory, basing allocations on the timing of beneficial use of overhead activities. The application benefits your utility's investment in smart metering and load-measuring technology.

Key article takeaways

1. Cost allocations make up a large percentage of costs for electric projects, and these costs must be recovered from customers in rates.

2. The foundation of the current cost allocation methodology rests in the 1992 National Association of Regulatory Utility Commissioners (NARUC) publication Electric Utility Cost Allocation Manual.

3. The two major approaches to cost allocations are (1) direct assign costs when possible and (2) if costs cannot be directly assigned, an accepted allocation method should be used.

4. A newer approach from the Regulatory Accounting Project (RAP) discusses a cost allocation approach based on time measurement of used and useful assets. The time measurement is made possible using load data from Automated Metering Infrastructure (AMI).

Pole construction

Current cost allocation foundation

Many current applications of cost allocations are based on the 1992 publication from the National Association of Regulatory Utility Commissioners (NARUC) Electric Utility Cost Allocation Manual. The base theory of cost allocation is based on two simplified rules:

1. Rule 1 - if a business unit, department, or activity is causing a cost to occur, it should pay for that cost.

2. Rule 2 - If Rule 1 cannot determine the cost causal factors, then an appropriate allocation method should be used.

Appropriate cost allocation methods utilize industry best practices such as allocating a cost based on an activity (number of accounts payable invoices per business unit, number of payroll transactions per business unit). If a specific activity does not drive a cost, then formulas such as the 3-factor or 2-factor are used to spread common costs among an organization's business units.

Utility Accounting and Rates Specialists provides on-line/on-demand courses on operations and construction project accounting, rates, and management for new and experienced co-op and utility professionals and Board Members. Click on the button to see courses that will enhance your career skills and provide value to your organization!

A new look at cost allocation methods

A 2020 publication from the Regulatory Accounting Project (RAP) Electric Cost Allocation for a New Era: A Manual , discusses the approach of applying cost allocations based on the timing of the use of electric assets by a business unit or customer. The manual's approach expands on the fundamental utility cost principle of "used and useful," which requires utility assets to be physically used and useful to current ratepayers before those ratepayers are asked to pay for the associated costs of those assets.

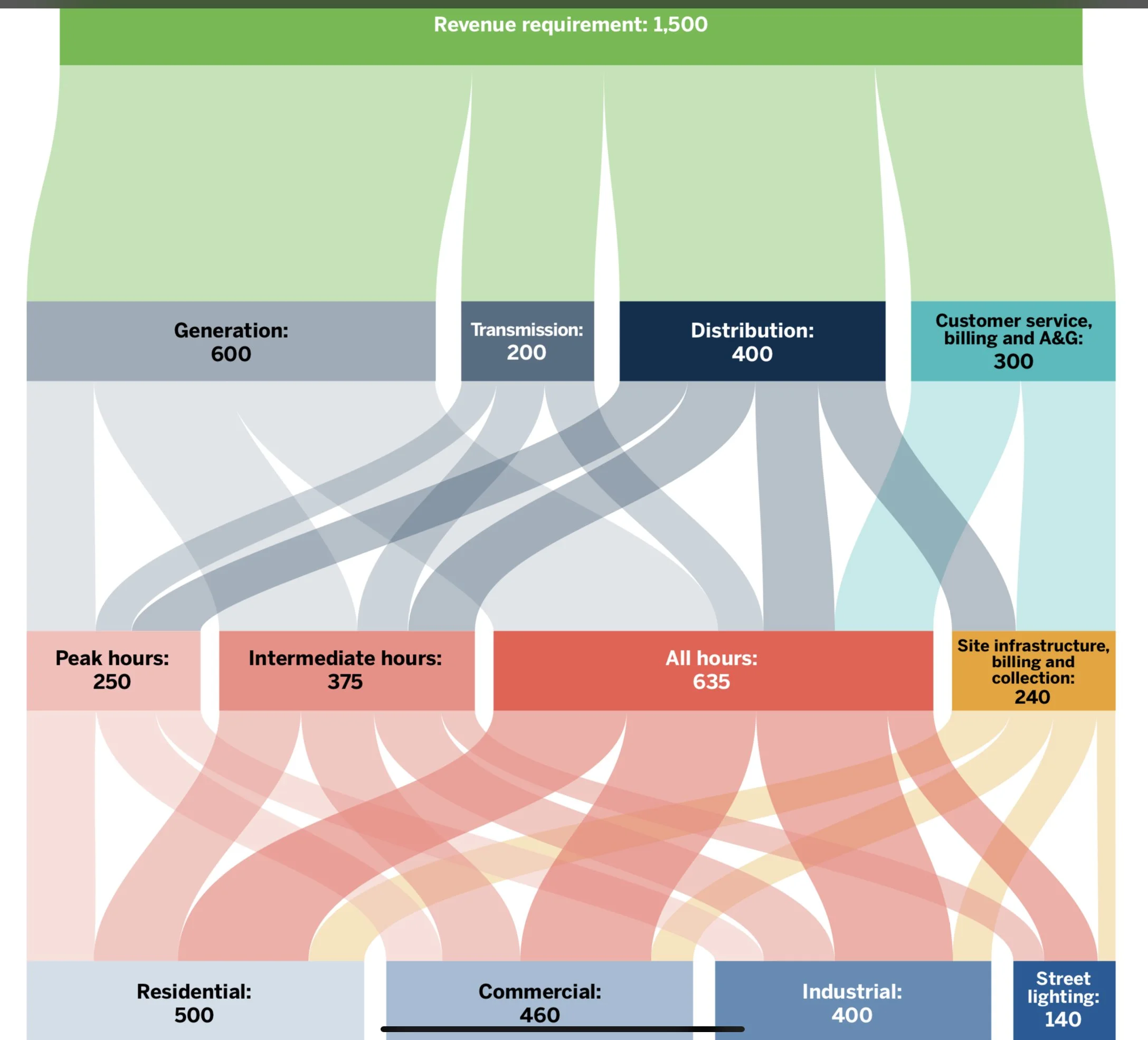

In the approach detailed in the RAP manual, the use of automated meter infrastructure (AMI), allows for determining the benefitting user of utility assets on an hourly basis. With the hourly information, costs can be allocated to the user in ongoing accounting allocations and cost of service studies . A graphic of the approach follows:

Courtesy of Regulatory Assistance Project (RAP)

Quoting the authors, "The innovations of this approach include:

A clear distinction between shared assets and customer specific assets in the accounting for distribution costs.

Clearer tracking of distinctions between system costs and overhead investments and expenses at all stages of the rate-making process.

More accurate definitions of rate classes based on emerging economic and service characteristic distinctions between customers.

Distinction between loads that can be controlled to draw power primarily at low-cost periods and those that are inflexible."

In plain language, cost allocations based on an AMI assessment of used and useful assets are a more defensible approach to allocating costs. The exciting exercise will compare current cost allocation results to an AMI-driven cost allocation process.

The RAP publication is quite technical and digs into the application of an AMI-driven cost allocation approach. Suppose your co-op or utility work area is in the finance, cost allocation, or rates area. In that case, this is a publication you should review for insights as to what most likely is the future of one of the major costs of service to customers.

About Russ Hissom - Article Author

Russ Hissom, CPA is a principal of Utility Accounting & Rates Specialists a firm that provides power and utilities rate, expert witness, and consulting services, and online/on-demand courses on accounting, rates, FERC/RUS construction accounting, financial analysis, and business process improvement services. Russ was a partner in a national accounting and consulting firm for 20 years. He works with electric investor-owned and public power utilities, electric cooperatives, broadband providers, and gas, water, and wastewater utilities. His goal is to share industry best practices to help your business perform effectively and efficiently and meet the challenges of the changing power and utilities industry.

Find out more about Utility Accounting & Rates Specialists here, or you can reach Russ at russ.hissom@utilityeducation.com.

The material in this article is for informational purposes only and should not be taken as legal or accounting advice provided by Utility Accounting & Rates Specialists. You should seek formal advice on this topic from your accounting or legal advisor.