Matching Derivative Gains and Losses to Electric Rates

Using ASC 815 and GASB 53 with ASC 980 and GASB 62 to defer derivative gains and losses protects your electric income statement

That headline is an alphabet soup but has a strong message. Derivative gains and losses are computed with ASC 815 and GASB 53. Using ASC 980 and GASB 62 can help smooth swings in derivative commodity values and have a soothing effect on the income statement.

This is an excerpt from our publication – “The Practical Guidebook to Utility Regulatory Accounting”. You can get the full copy at our Resource Library. It sounds like a dry topic (and it can be), but it is necessary knowledge to ensure rate recovery from your customers for revenues that should be tied to a corresponding event or to be recognized over a longer time-frame than that allowed under regular generally accepted accounting principles.

1. Deferred gains on mark to market investments and derivative contracts

Situation

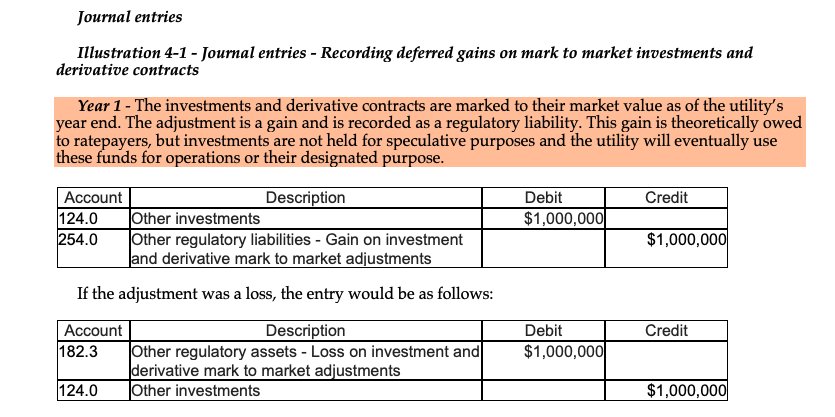

Governmental Accounting Standards Board Statement No. 31 Accounting and Financial Reporting for Certain Investments and for External Investment Pools requires that investments and certain commodity derivatives be marked to their market value as of the utility’s year-end. The utility’s investments and derivatives calculate to a mark to market gain of $1 million as of the utility’s year-end.

Utility Accounting and Rates Specialists provides on-line/on-demand courses on operations and construction project accounting, rates, and management for new and experienced co-op and utility professionals and Board Members. Click on the button to see courses that will enhance your career skills and provide value to your organization!

The exit strategy

The utility does not speculate in investments or derivatives, generally holding them to maturity. The utility presents its oversight Board with a resolution for blanket approval to record a regulatory deferral based on ASC 980 or GASB 62 for any mark to market differences at the end of each year. The resolution calls for a true-up of any differences between the mark to market and actual values on the sale or use of these assets. The board approves the resolution.

Annually, the investments and derivative contracts are marked to market. Gains or losses flow through a regulatory liability (gains, recorded in FERC Account 254.0 “Other regulatory liabilities”) or a regulatory asset (losses, recorded in FERC Account 182.3 “Other regulatory assets”).

Industry best practices are to make this entry annually as of the organization’s reporting period. However, some entities make this a part of their monthly closing and financial reporting process.

Impact on rates

There is no impact on rates. These entries are non-cash adjustments.

Financial statement presentation

Presentation in the financial statements is as a regulatory asset or liability (current or non-current depending on the timing of the investment or contract maturity).

Why do this?

Using ASC 980/GASB 62 as described in this article recognizes that your organization most likely has not changed the process and mechanism for recording gains or losses from ineffective derivative contracts, but accounting standards require you to report differently. As with any other use of regulatory accounting, the goal is to match recognition of an event to recovery from customers in their rates. In most cases, the derivative contracts will be held to delivery, so recognition of swings in market prices prior to delivery does not provide value to the financial statement from a rates perspective.

About Russ Hissom - Article Author

Russ Hissom, CPA is a principal of Utility Accounting & Rates Specialists a firm that provides power and utilities rate, expert witness, and consulting services, and online/on-demand courses on accounting, rates, FERC/RUS construction accounting, financial analysis, and business process improvement services. Russ was a partner in a national accounting and consulting firm for 20 years. He works with electric investor-owned and public power utilities, electric cooperatives, broadband providers, and gas, water, and wastewater utilities. His goal is to share industry best practices to help your business perform effectively and efficiently and meet the challenges of the changing power and utilities industry.

Find out more about Utility Accounting & Rates Specialists here, or you can reach Russ at russ.hissom@utilityeducation.com.

The material in this article is for informational purposes only and should not be taken as legal or accounting advice provided by Utility Accounting & Rates Specialists. You should seek formal advice on this topic from your accounting or legal advisor.